Job market paper: Beyond the Shelf Price: Alcohol Sales Taxes and Alcohol Consumption

Abstract

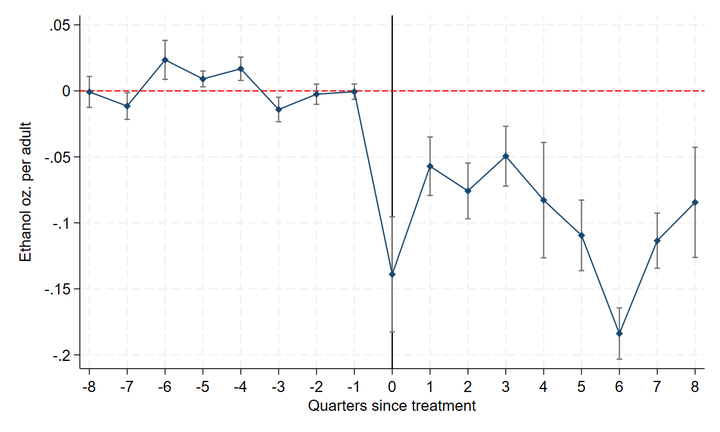

While most research on alcohol taxation examines volume-based excise taxes, much less is known about the effects of sales taxes, which are applied as a percentage of retail prices and may differ in salience and incidence. This paper evaluates the impact of Maryland’s 2011 three percent alcohol sales tax on household alcohol purchases using NielsenIQ Consumer Panel data and a synthetic difference-in-differences approach. I find that the tax led to a roughly ten percent decline in monthly ethanol ounces purchased per adult per household, equivalent to about two fewer standard drinks per adult per month. Purchases declined across beer, wine, and spirits, providing no evidence of substitution across beverage types. Heavy drinkers also reduced their purchases, while low-income households exhibit more constrained substitution patterns. These results provide new evidence on the behavioral effects of sales taxes and highlight the potential of price-based alcohol policies to reduce consumption and related harms.