A New Look at the Impact of Beer Taxes on Alcohol-Impaired Traffic Fatalities

Abstract

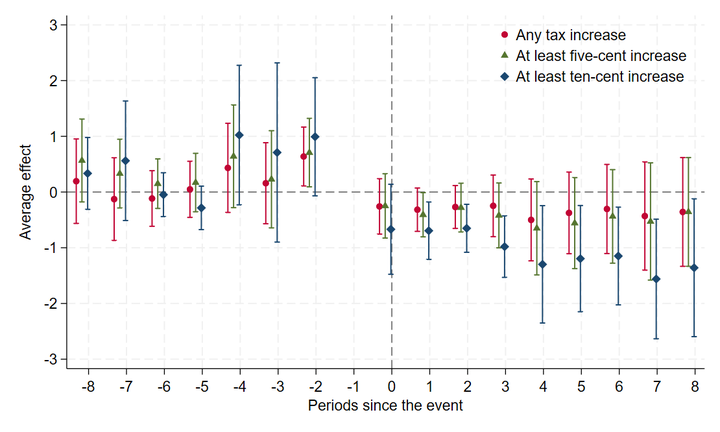

Few definitive findings have emerged from the literature studying the impact of beer taxes on traffic fatalities, and as a result, the alcohol tax policy landscape has remained largely unchanged over the last few decades. This paper reexamines the effect of beer excise taxes on alcohol-impaired traffic fatalities in the United States. Using updated data from the National Highway Traffic Safety Administration and a fixed effect Poisson model, we find consistent evidence that beer taxes reduce alcohol-impaired traffic fatalities. Results are consistent across age groups and times of day and are robust to numerous model specifications, including dynamic event study estimators. Overall, our results provide evidence that beer taxes may be a productive tool to reduce alcohol-impaired fatalities.